PaymentWorks and the Vendor Onboarding Process

Anyone seeking to do business with or be paid by the University needs to be set up as a vendor.

PaymentWorks is the vendor onboarding and management system used by Columbia to invite vendors (both entities and individuals) who are new to the University or existing vendors who have not yet completed the PaymentWorks onboarding process. Vendors will receive an invitation to register from Columbia and will be able to enter all of their information safely and securely.

For more information, visit PaymentWorks - How it Works.

Training

Creating a PaymentWorks Account and Registering as a Columbia University Vendor

Registering as a Vendor for Individuals Receiving Payment or Reimbursement

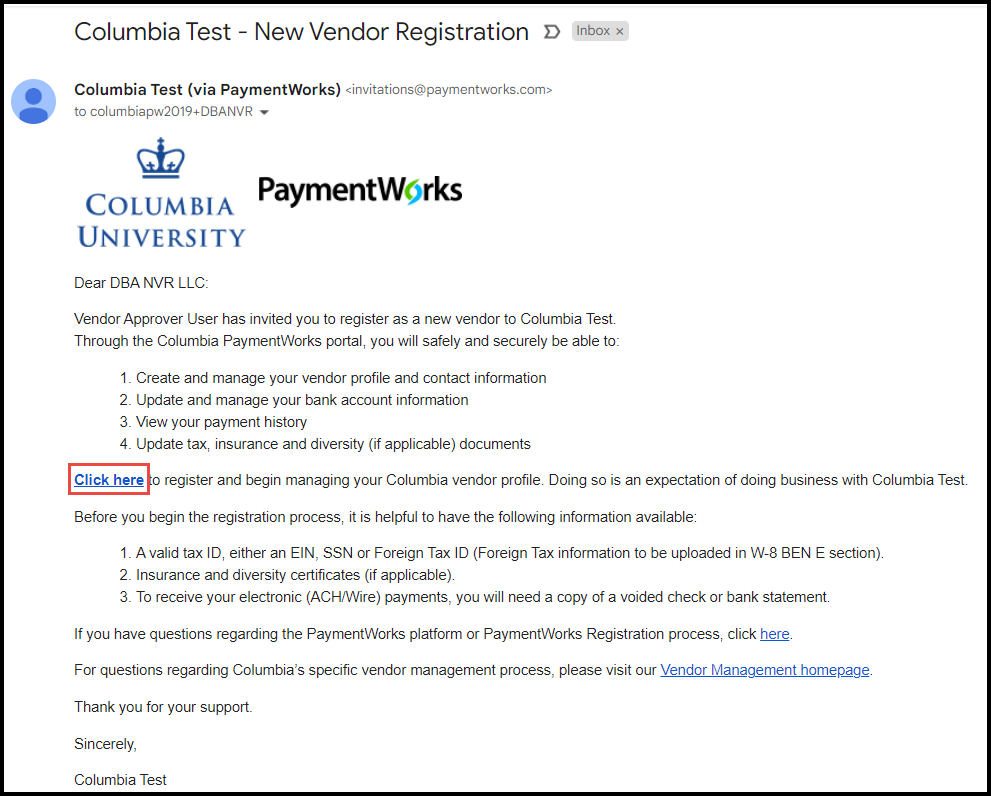

- You will receive an email inviting you to register with PaymentWorks and complete the New Vendor Registration form.

- The New Vendor Registration form allows you to:

- Enter your business details such as address, tax, banking, insurance, etc.

- Update Columbia specific information with any future changes

- It is important to use the invitation link to begin your registration to Columbia University via PaymentWorks. If you are not the right person to complete the New Vendor Registration form, please forward the email to the appropriate contact at your company.

- If you already have a PaymentWorks account but are not yet connected to Columbia, you must still be invited by Columbia in order to connect. You need to complete all of the required fields on the New Vendor Registration form including the Columbia specific information.

Below is a sample invitation email. Click the highlighted link in your email to begin the registration process.

When completing the PaymentWorks New Vendor Registration form, most of the requested information is standard across for all customers who use PaymentWorks. In addition to this standard information, Columbia requests additional information outlined below.

US Entities and Individuals

Diversity information (US Entities Only)

You are required to indicate if your business is a certified diverse business (such as a minority-owned, woman-owned, or veteran-owned business). If you select Yes, you must choose the applicable diversity certification type, indicate the expiration date of your certification and/or the last date of your Certification Attestation/Affidavit and then upload the actual Certificate and/or Attestation documentation. Other fields may be required based on the applicable diversity certification you select.

For more information:

Office of the President: Columbia's Commitment to Diversity

Facilities and Operation: Minority, Women and Locally-owned Business Enterprises

Facilities and Operation: CU Grow Program

Payment Information

If you indicate that you are using a US Bank, you must select if your Payment Method is ACH (Preferred) or No ACH.

If you select No ACH, you must select the non-ACH Method (Wire or Check). The Non-ACH payment method requires additional approvals so you will be required to provide Check or Wire Payment Method Comments / Justification.

Foreign Entities and Individuals

W8 or W9

Be sure to upload the correct W-8 or W-9 form using the Choose File button in the W-8 BEN or W-9 Tax Information section. You can upload any W-8 form that applies, including a W-8BEN, W-8 ECI, W-8 IMY, W-8 EXP, or 8233. If you have a Social Security Number (SSN), an Individual Taxpayer Identification Number (ITIN), or a Taxpayer Identification Number (TIN), upload form w-9. You can find tax forms here.

Please review the completed and signed forms for accuracy and completeness prior to uploading. If your name or address on the form does not match the one you entered in the PaymentWorks new vendor request form, the request will be returned.

If you upload a W-8 form, be sure to enter the W-8 Signature Date in the Additional Information section of the new vendor registration form. The W-8 expiration date is the Signature Date plus 3 years. The expiration for form 8233 is the last day of the current calendar year.

Finally, print to/save your W8 or W9 form as a PDF with no editable fields and upload this version to your NVR. Tax forms that contain editable fields are not allowed by the IRS and will result in having your NVR submission returned.

Tax Obligation

Foreign Entities and Individuals that perform their work or activities on US soil are responsible for their tax obligation. Vendor payments will include withholding of taxes payable to the IRS.

Payment Information

If you indicate that you are using a Foreign Bank as your Bank Location, you must select if your Payment Method is Wire or Wire Not Available.

The Wire Not Available payment method requires additional approvals so you will be required to enter a Foreign Wire Not Available Payment Method Comments / Justification in order to be paid by check.

If your Payment Method is Wire, you will be required to indicate if you are using an Intermediary Bank. If you are using an Intermediary Bank you will need to provide additional bank details including Intermediary Bank Name, Intermediary Bank Account Number, Intermediary Bank SWIFT Code / IBAN Number. Regardless of whether you are using an Intermediary Bank, you will be required to provide the Beneficiary Bank IBAN Number or enter NA and populate the SWIFT Code in the Banking Section.

Facilities Supplier of Goods and Services

If you select Facilities Supplier of Goods and Services as the Vendor Classification, you must enter a Company Signatory Name, select Primary or Authorized signer, and choose a Primary Trade & Specialty and Union Type.

Union Status

In the Union Status dropdown, you can select Union, Non-Union, or Both. Indicate Both if some parts of your business are unionized while others are not.

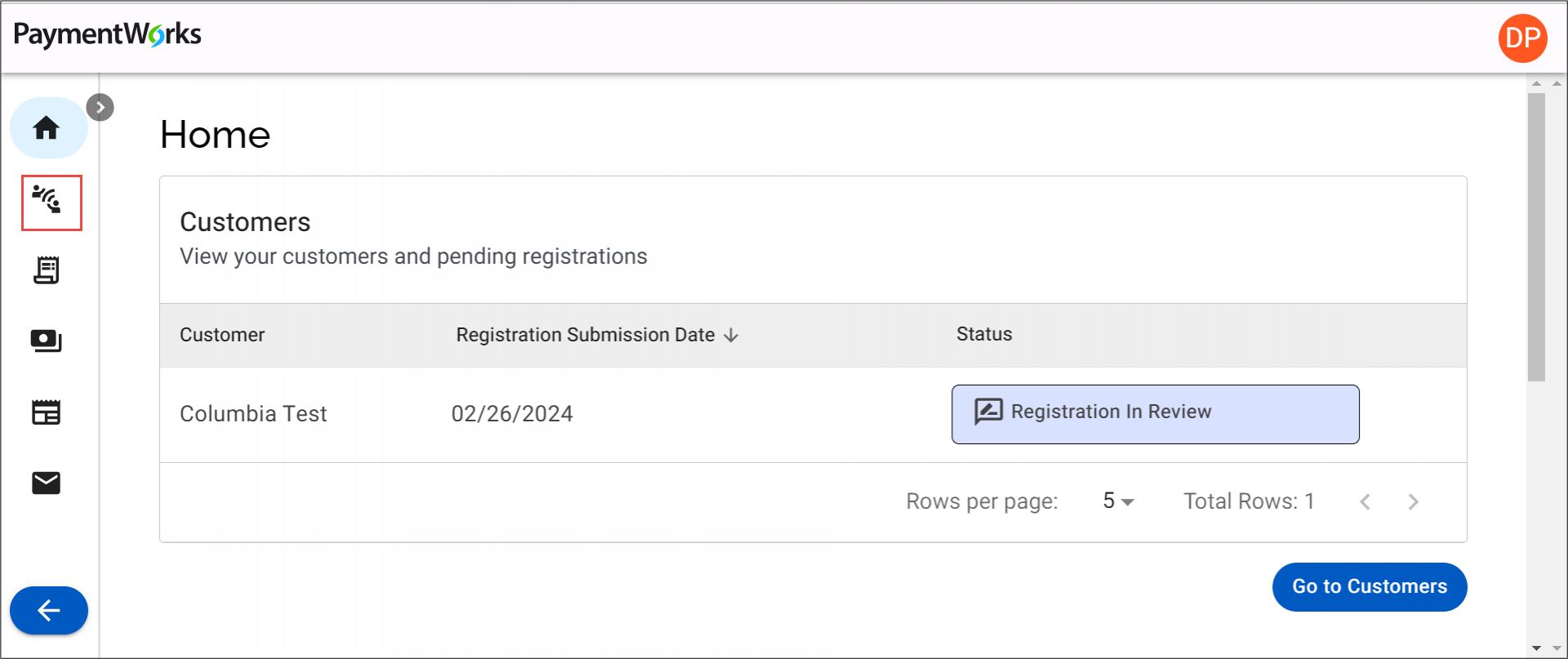

You can track the status of your connection to Columbia and other customers you may have connected to using PaymentWorks.

Login to your PaymentWorks Account. Your onboarding status appears on the Home or Customers page.

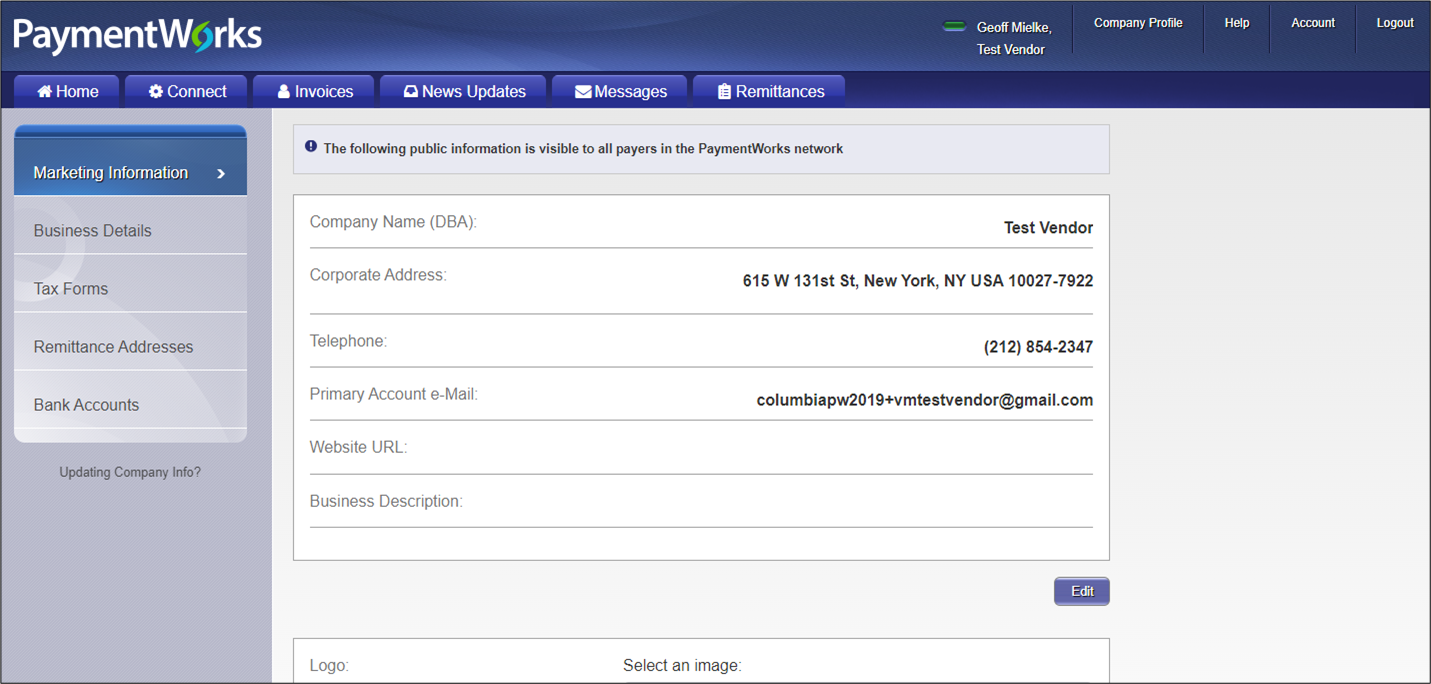

After you have submitted a New Vendor Registration form, your Company Profile will be created; this is where you can update your business/personal information, as needed. To review and/or update your registration information, click the Profile icon with your initials and select Company Profile. Refer to the Updating Company Profile Information web tutorial.

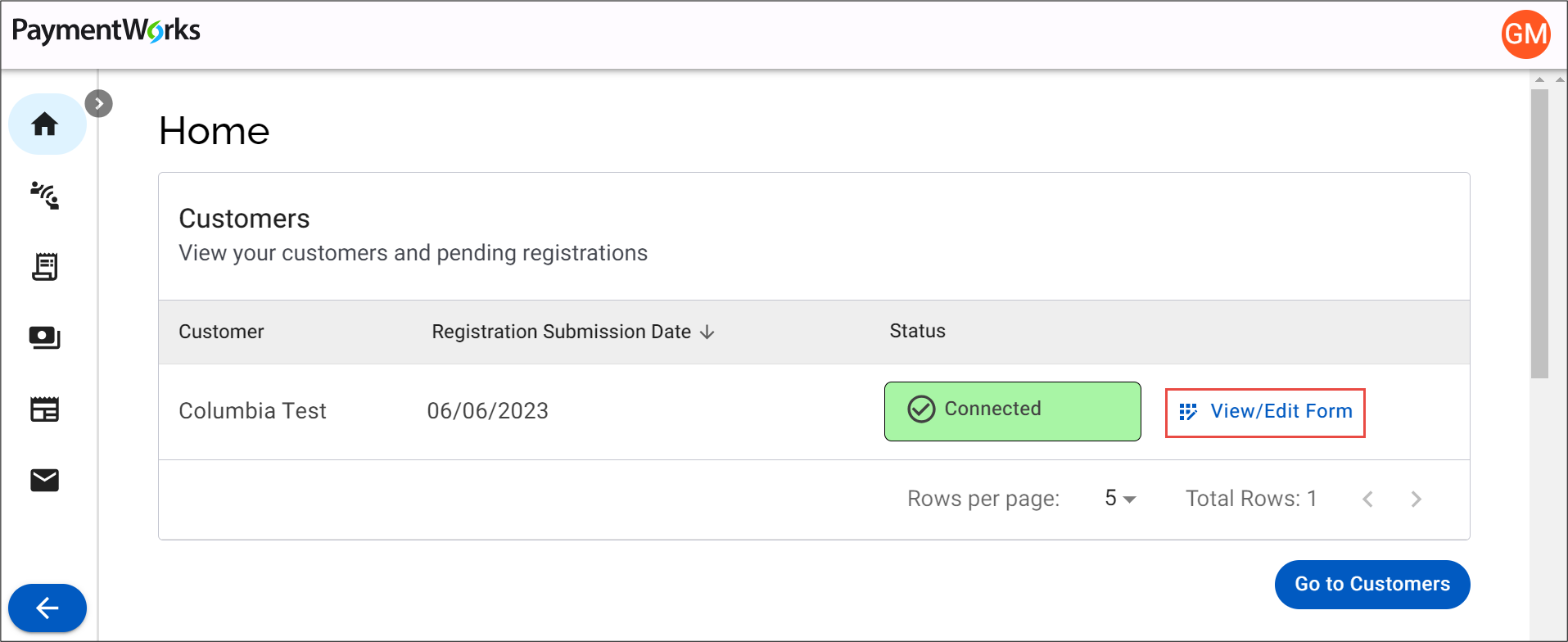

Updating Columbia Specific Information

As a PaymentWorks vendor, you may need to manage information specific to Columbia that does not apply to your other customer(s).

- Log in to your PaymentWorks account and navigate to the Home or Customers pages to view your Customers.

- Click the View/Edit Form link for Columbia University. The form appears where you will be able to make updates.

PaymentWorks will only display the invoices you submitted to Columbia that were Paid or Rejected (not in process). Inquiries regarding invoice or payment status should not be made through PaymentWorks.

To view your invoices being processed by Columbia, refer to the Columbia Finance AP Payment Status & Remittance page where you can look up Payment Status and Remittance Information. You will need your Columbia Vendor ID to lookup Payment Status and Remittance information: refer to the ARC Vendor ID Lookup page where you can search for your Vendor ID Number in our financial system (ARC).

Still have questions?

If you have questions regarding the PaymentWorks platform or the PaymentWorks Registration process, you can search the PaymentWorks Support Center topics or contact PaymentWorks Support.

For questions regarding Columbia’s specific vendor management process, please visit our Vendor Management homepage. If you still have questions, submit a ticket to the Finance Service Center.